For any business we have to maintain a proper financial status for that “Zoho payroll” will have proper management. By using payroll we can give on time salaries to our employees, by using this we can generate payslips to the employees.

Zoho payroll is a cloud-based application, we can download the payroll app for ‘Ios’ and ‘Android’ mobiles and we check it from our mobile, otherwise, we can access it from the web browser.

Setting up with Zoho payroll:

Before running your pay runs you have to set your organization information this process will have five steps.

- Organization setup

- Tax information

- Pay schedule

- Statutory components

- Salary components

Step 1: Organization setup:

- Enter your Organisation Name, Business Location, and Industry.

- Enter your Organisation Address. This address will be reflected across all your Zoho Finance applications and it will take as the primary work location.If your business has multiple locations, you can add them by going to Settings > Work Locations.

- If you are already running your payroll import all the data you have made for your employees.

- Then Click Save & Continue.

Step 2: Tax Information:

- In the step2 you have to enter all your tax details like “PAN, TAN and TDS Circle / AO Code”, this details will be displayed in form 16 which is displayed for the employees.

Step 3: Pay Schedule:

- It is the combination of two things one is “on which data the salary has to be given for the employees ” and one more is ”This will remind you to pay payrolls on time”.

- Select your work week, which is the number of days your business works in a calendar week.

- Select whether you have to give your employees a salary based on monthly, which is the number of days in a month or for a fixed number of days(28).

Step 4: Statutory Components:

- These are the components that are held by the government bodies like “ Employee Provident Fund Organisation (EPFO) and Employees’ State Insurance Corporation (ESIC).

- Contributions are made by the employees by the employer ‘for the employee long term financial status’.

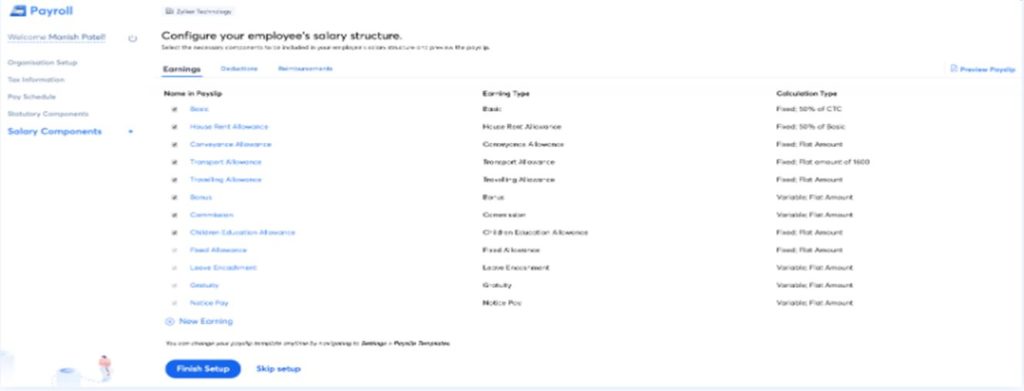

Step 5: Salary Components:

- In this section, you can select all the earnings, deductions and reimbursements that your organization offers to its employees.

- Click the salary component to modify the name in Payslip, Calculation Type, Amount / Percentage and so on.

Screening of Zoho PayRoll:

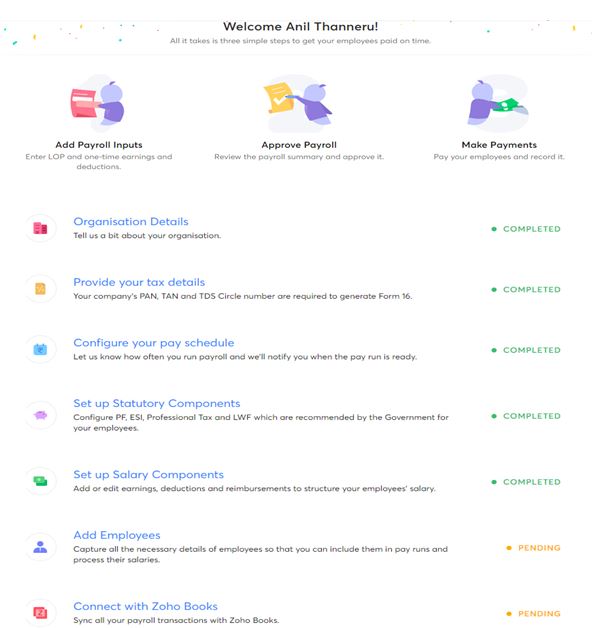

- After doing setup with all the five steps you will enter into the home page and then you will see the welcome note.

- After entering into the home page it will show you the two pending setups one is “add employees and another one is Connect with Zoho books”, After the completion of the pending setup you are ready to access the Payroll.

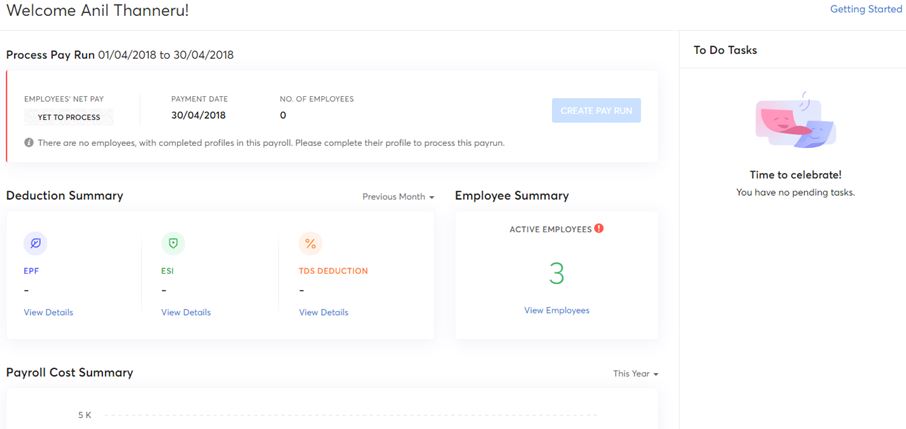

Home

- When you log in to your account first you will see the home page where you can access the overview of your organization. In the home page, you can see the “active employees and ESI, EPI’s deduction summary.

- How many employees are there in the organization and you can see how much amount you have spent in the payroll.

- We have process pay run in this we can see the upcoming payments and pending approvals.

- We have a “To do Task column ” here we can track our pending approvals from your home screen.

Employees:

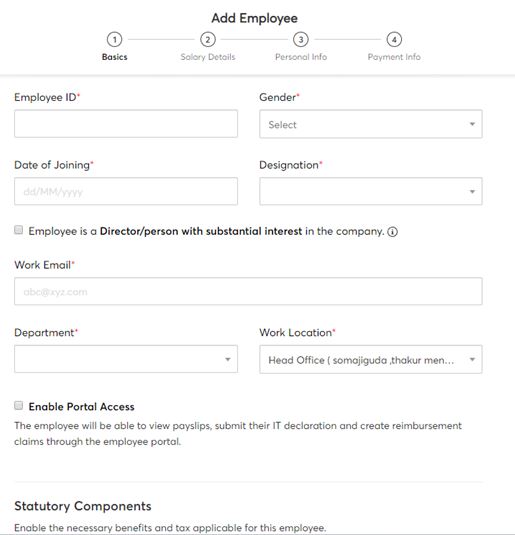

- In employees module, we can add the employee, delete the employee, edit the employee, and we can terminate the employee.

- By adding employees manually you have to give the “basic information of employee, salary details, personal info, and payment info.

- If you miss any field to fill in the employee form it will show as the employee pending.

- You can also extract the employee information in the form of pdf and xl sheets.

Pay Runs:

- Pay Runs it has two modules one is ‘Run PayRoll’ and another one is ‘PayRoll history’.

- Pay runs schedules on a particular date which we are given in the payment schedule.

Run PayRoll:

- Pay Run is a module where you can access all the pay run and employees net pay and employees payment date and on which data the payment has to be done.

- You can see how many employees are getting payroll.

PayRoll History:

- In this, we can see all the payroll which we have done still the data.

Approvals:

- In this, we can claim your investment which has done for the company needs and we can claim the amount that we have spent by submitting your proof of investment in the form of Reimbursement, Proof of investments and Salary Revision.

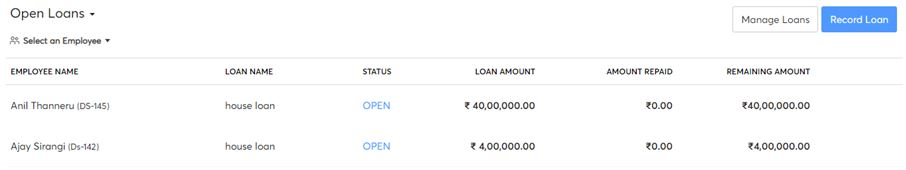

Loans:

- The loan module in the Zoho payroll will help you to manage all the loans that you have provided for your employee and you can deduct repayments from the employee’s salaries each month.

- If we have any loans you can integrate it with payroll and your ‘Emi’ can directly deducted from the salary account.

Form 16:

- The form16 is for the employee benefits like ‘EPF’ and ‘ESI’.

- It contains two parts 16A and 16B.16A is for employees who can change his job in one financial year for them the form 16A is issued for the period of employment.

- If you change your job in one financial year, you have to decide if you would want part B of the form from both employers or from the last employer.

Integration:

- We can integrate Zoho Payroll with Zoho Books and Zoho People.

“ZOSuccess” is the Zoho Consulting Practice of Dhruvsoft Services Private Limited – a leading Zoho Advanced Partner from India – providing services worldwide …

“ZOSuccess” is the Zoho Consulting Practice of Dhruvsoft Services Private Limited – a leading Zoho Advanced Partner from India – providing services worldwide …